This story is part of Forbes’ coverage of China’s Richest 2024. See the full list here.

A raft of measures designed to halt the property slump and fire up economic growth energized mainland China’s stock market, though concerns over structural challenges still linger. The benchmark CSI 300 index rose 12% since we last measured fortunes a year ago, propelling collective wealth, which had fallen below $1 trillion two years ago, to once again breach the 13-figure mark. That’s up 15% over last year’s combined $895 billion. The minimum net worth to make China’s top 100 increased to $3.9 billion, up from $3.4 billion in 2023.

A total of 60 fortunes are up this year but 22 bucked that trend to record net worth declines. A notable person in the latter category is water and beverage tycoon Zhong Shanshan, founder of Nongfu Spring, which has faced an intense price war in China’s bottled-water market. Zhong’s wealth shrank by $9.3 billion—the biggest drop in dollar terms—to $50.8 billion, though he retained the No. 1 rank for the fourth year in a row.

The biggest dollar gainer is Ma Huateng, chairman of Tencent Holdings, who added $14.7 billion to take his fortune to $46.8 billion and moved up two places to No. 2, a position he last held in 2020. Shares of the internet behemoth jumped 49% over the past year on higher revenue from online games, streaming services and advertising.

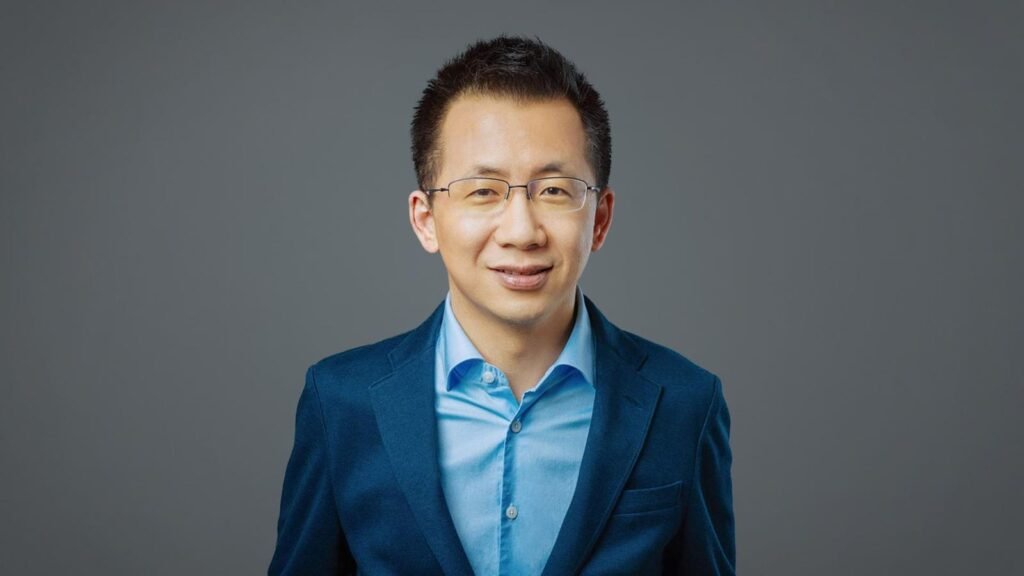

ByteDance cofounder Zhang Yiming slipped one spot to No. 3 despite eking out a 5% rise in his net worth to $45.6 billion. The owner of TikTok continues to face regulatory challenges overseas—in May, ByteDance sued the U.S. government to overturn a law mandating it to sell the short video app or face a nationwide ban. PDD Holdings founder Colin Huang fell to the fourth place despite adding $7.7 billion to push his wealth up to $43.9 billion. The e-commerce giant has become the go-to destination for China’s increasingly frugal shoppers but is facing earnings pressure with its plans to scale up supply chain investments and increase support to vendors.

Another notable gainer is Zhu Yi, chairman of Biokin Pharmaceutical, whose net worth more than doubled to $8.2 billion. The company’s subsidiary, SystImmune, signed an $8.4 billion deal last year with U.S. biopharma heavyweight Bristol Myers Squibb to jointly develop and commercialize a potential cancer treatment worldwide.

There are eight newcomers this year, including Cai Haoyu, Liu Wei and Luo Yuhao, the three cofounders of privately held online games developer miHoYo, which has attracted legions of fans worldwide with its anime-styled games. Toy magnate Wang Ning enters the ranks as his Pop Mart International Group, seller of “blind boxes” that each contain a mystery collectible figurine, logged stellar revenue growth from stepping up overseas expansion. Zong Fuli, 42, the youngest among 11 women on the list, replaces her father, Zong Qinghou, founder of privately held water and beverage giant Hangzhou Wahaha Group, who died in February.

Ten tycoons returned to the ranks after dropping off previously. The wealthiest in this group is chairman of chipmaker Cambricon Technologies, Chen Tianshi, who reappears after a three-year gap at No. 46 with $7.27 billion. Riding the AI boom, the company’s stock more than tripled from a year ago.

Among the 17 dropoffs is Yang Huiyan, chairman of debt-laden property developer Country Garden Holdings, which suspended trading of its shares on the Hong Kong stock exchange in April.

Full Coverage of China’s Richest 2024:

Reporting by Matt Durot, Enyi Hu, Shanshan Kao, Zinnia Lee, Chengbo Liu and Catherine Wang.

Methodology:

This list of mainland China’s richest was compiled using shareholding and financial information obtained from families and individuals, stock exchanges, analysts, private databases and other sources. Net worth figures are based on exchange rates and stock prices on Oct. 18, 2024. Private companies are valued by using financial ratios and other comparisons with similar companies that are publicly traded. Some family fortunes were split. In order to facilitate comparisons among individuals with similar backgrounds, we include a number of entrepreneurs from mainland China whose citizenship is not People’s Republic of China but whose main source of wealth is the mainland. The editors reserve the right to amend the list in light of new information.

Acknowledgement:

Special thanks to Caplight Technologies, Euromonitor International, Nomura and other experts who helped us with our reporting and valuations, including Charlie Chai, 86Research; Wayne Fung, CMB International Capital; Tina Hu, DBS Securities China; Roman Kalyuzhny, PM Insights (formerly ApeVue); Shen Meng, Chanson & Co; Saikat Saha, Mordor Intelligence; Zhang Yi, iiMedia Research; Stan Zhao, Blue Lotus Capital Advisors.

Read the full article here