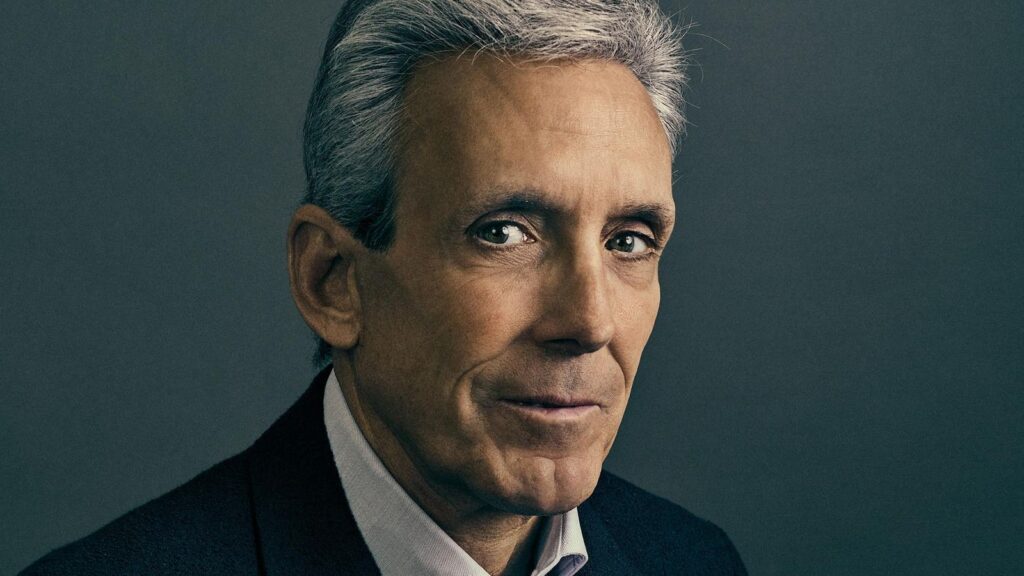

New York billionaire Charles Cohen took over his family’s real estate firm from from his dad and uncles, and kept expanding. Now he’s battling multiple foreclosures and working on a plan to save his fortune.

By Giacomo Tognini, Forbes Staff

OnJanuary 15, real estate billionaire Charles Cohen called Forbes from a no caller ID phone, as he always does. For four months, Forbes had been trying to get Cohen to sit down and discuss the mounting debt and vacancies at the buildings owned by his real estate firm, Cohen Brothers Realty. In September he said to check back in November. In November, he said to call in January. Last week, Cohen said he was going on vacation. He didn’t specify where, but he often jets to his vineyard in the south of France, Château de Chausse, or his Palm Beach penthouse. (He also has apartments in West Hollywood and Manhattan and a sprawling home in Greenwich, Connecticut.) Then he asked if the story could be delayed once again for four to six weeks, when he would explain how his firm had “turned the corner.”

“If you run a negative story, it’s going to hurt me,” he said, mentioning several refinancings and new leases he claimed were in the works. “It makes it harder for us to rent when people think there’s a problem that really isn’t a problem.”

Cohen finally relented, only after Forbes explained the story would run regardless, and had his executive vice president sit down with Forbes to go over financials.

There is no doubt that Cohen, who took over his father and uncles’ firm in the 1980s and expanded it by building and buying prime office towers in midtown Manhattan, now finds himself in a tricky spot. Since the pandemic emptied offices, many of his prized properties lost tenants. At least six of his buildings sit more than 20% empty, with three of those less than 60% occupied. At the same time, he’s struggled to make payments on at least $1.1 billion in debt according to loan filings and court documents, resulting in the loss of four properties at a foreclosure auction in November.

All of that has dealt a blow to Cohen and his fortune, which peaked at $3.7 billion in 2022, when he was flush with cash and interest rates were near zero. Forbes now estimates he’s worth $1.6 billion. About two-thirds of that lies in his real estate holdings, which have lost value as tenants fled to newer, amenity-rich skyscrapers.

Cohen disputes the valuation, claiming it should be higher. Steven Cherniak, Cohen Brothers’ chief operating officer, said that the firm is up-to-date on loan payments for buildings that carry more than half that $1.1 billion debt load. Plus, Cherniak is confident the properties will land more tenants in the first half of this year.

Cohen’s troubles made headlines on November 8th, when one of the largest foreclosure auctions in New York history took place. Up for sale were five of his holdings: an 800,000-square foot office and design complex in Dania Beach, Florida, a nearby Le Meridien hotel, a former hotel site in Rye Brook, New York, and theater chains in the U.S. and the U.K.

At the end of the bidding process, Cohen’s creditor, Fortress Investment Group, walked away with nearly everything, paying just under $150 million for the design complex, hotel, U.K. theater chain and Rye Brook site. No one bothered to bid on the U.S. chain Landmark Theaters, with its 28 locations and concessions business, leaving them in Cohen’s hands.

It was the latest episode in a long-running battle between Cohen and Fortress. The lender sued Cohen last March, seeking repayment of a $534 million loan secured by the properties. Representatives for Fortress didn’t respond to a request for comment. Cohen and his company counter-sued.

The auction, for which Cohen was a no show, was another setback for the real estate mogul and movie buff. For years, the collection of office towers in midtown Manhattan he’d assembled provided steady profits. He then expanded into design centers and indulged his passion for film, producing several Oscar-nominated films (and one best foreign-language film winner, “The Salesman”), buying arthouse theater chains and launching a film distribution business. He also bought a 135-acre vineyard and estate in France in 2016 and men’s high-end footwear brand Harry’s of London a year later.

But in the past two years, he’s had to deal with mounting troubles at his office towers. He lost several major tenants—including WeWork, which vacated more than 200,000 square feet at several properties while keeping much less space—and debts racked up as repayment dates loomed. His buildings struggled to compete with brand new skyscrapers with luxury amenities, making it tougher to replace those leases, according to several brokers. High interest rates also made it harder to refinance, and when he did—as with the Fortress loan—it was on unfavorable terms. At the same time, the rest of his empire also took a hit. The pandemic shuttered his theaters across the country, and his design centers lost tenants, too: he lost the one in Florida to Fortress but has three more, including two in Los Angeles and New York where occupancy has dipped below 80%.

For his part, Cohen insists the picture isn’t as bad as it looks, pointing to better leasing activity and a recent uptick in sales of office buildings. At one of his properties, 750 Lexington Avenue—home to the headquarters of his firm—the lender filed for foreclosure in May, a month after the building was reappraised at just $50 million, down from $300 million in 2015. But the foreclosure has stalled, while one tenant, beauty retailer Sephora, renewed its lease and another tenant, WeWork, kept its lease after emerging from bankruptcy. Cohen Brothers is working on a loan modification with the lender.

“We’re doing fine. We’ve got leasing challenges, which everyone has, but we’ve got good buildings,” Cohen told Forbes in a phone call 10 days after the auction in November. “We have very strong tenant retention and expansion, and we’re probably doing more leasing than a lot of other people.”

Outside of New York, he’s expecting to break ground soon on a 23-story, glass-clad office tower in West Palm Beach, where demand for office space remains strong, especially for new buildings.

“I’m doing everything that I need to do everywhere,” he asserted.

Cohen was born in 1952 into a real estate family in Harrison, north of New York City. His father, Sherman, was a former car dealer who built Cohen Brothers Realty with his two brothers; the siblings eventually grew it to more than 20 buildings across Manhattan.

As a young child, Cohen was more interested in show business, developing a love for movies after his grandmother took him to see Cinderella at age 3. By the time he was a teenager, Cohen was showing apartments for his family’s real estate firm. But he also knew he wanted to become a director and even shot a few short films.

“When I turned 14, I stopped following the Yankees and started reading Variety,” he told Forbes in 2017. “There was nothing more exciting to me than being in line to see a movie when it opened.”

It would be a while before he pursued his filmmaking dreams. The first in his family to graduate from college, he got his bachelor’s at Tufts University in 1974 and a law degree from Brooklyn Law School in 1977 before working in Chemical Bank’s real estate division in New York for a couple of years. He then joined his family’s firm and rose to become vice president and general counsel by 1981.

Just two years later, he became president and bought out his father’s and uncle’s stakes in the company for an undisclosed sum. One of his signature deals was the construction of 750 Lexington Avenue. Cohen bought up the entire block between 59th and 60th streets in the 1980s to build it. (One resident on the block held out and refused to sell her townhouse, leading Cohen to build the 28-story tower around it; it’s still there)

Cohen expanded into design centers in the 1990s, purchasing the Decoration and Design building in Manhattan for $63 million in 1996 and adding the Pacific Design Center in Los Angeles and the Design Center of the Americas in Florida three years later for an undisclosed sum. By 2009, he had expanded the firm to more than 12 million square feet of real estate—up from 3 million when he took over in the 1980s.

At the time, he also pivoted back to his fervor for filmmaking. He put up half the budget for the independent film “Frozen River,” which won the Sundance Film Festival Grand Jury Prize in 2008, and then set up a movie distribution business the same year. Over the following decade, he picked up a historic film collection, a small-screen theater in Manhattan plus Landmark and Curzon, two theater chains in the U.S. and the U.K. He also began spending more time in France, purchasing the Château de Chausse wine estate in Provence in 2016 for $20 million and picking up a historic Japanese-style theater in Paris a year later.

He joined The Forbes 400 list of richest Americans for the first time in 2016 with an estimated $2.8 billion net worth. That same year, coworking outfit WeWork leased four floors at Cohen’s office tower on East 57th St. By 2018, the startup had expanded to 123,000 square feet there and also took more than 80,000 square feet at 750 Lexington.

When WeWork’s public listing collapsed in September 2019, Cohen was left with a looming leasing problem as the startup’s cash was predicted to dry up. Six months later, the Covid-19 pandemic hit. The downturn was devastating for New York office landlords. By the end of 2020, the value of the city’s office buildings had fallen by 45%, an estimated $50 billion decline, according to a research paper published in 2022 by Columbia and New York University professors Arpit Gupta, Vrinda Mittal and Stijn van Nieuwerburgh.

“In the future, this period of time will be called the great valuation reset,” says longtime New York real estate broker Bob Knakal. “People have to get tuned in with the reality of what the present market is.”

Cohen, though, had locked in fixed-rate loans on several of his largest properties—including 750 Lexington Ave and the New York design center—in the years before the pandemic. In 2022, as the Federal Reserve began raising interest rates to battle high inflation, he chose to take advantage before rates got too high. In September that year he refinanced four properties and the two theater chains with a $534 million loan from Fortress.

According to financial documents revealed in the Fortress lawsuit, Cohen’s empire was already feeling the pain by the 2022 refinancing. An independent auditor’s report compiled in December 2022 stated that the firm was dealing with “net operating losses” and “high vacancy rates” which “raise substantial doubt about the company’s ability to continue as a going concern.” The report also noted that the firm had pursued “significant efforts to increase occupancy and cost control measures” and also had “adequate cash resources and business continuity plans.”

In the spring of 2023, Forbes investigated the collapse of commercial real estate values across major cities in the U.S. “You’ve got to be defensive,” Cohen told Forbes at the time, when asked about his strategy to survive the downturn. On his debt, he said: “It’s not an issue of imminent concern to me. We’re keeping lenders apprised of what’s going on, being transparent, explaining why things are the way they are.”

Throughout the rest of that year, Cohen and Fortress extended the payment schedule on the loan and deferred payments, according to court filings. In November 2023, WeWork filed for bankruptcy and vacated more than 200,000 square feet at two Cohen properties in Los Angeles and New York—the latter bearing a mortgage owed to Fortress, and where WeWork had leased nearly a third of the total space.

Tensions came to a head in February 2024, when Cohen and Fortress were negotiating a further extension. In emails revealed in court records, Cohen pushed back on Fortress’ proposal but expressed hope that they would come to an agreement: “Over the last 20-plus years, we have always found a way forward together.”

Dean Dakolias, Fortress’ co-chairman and managing partner, fired back a blunt response. “Your last proposal was unrealistic and took us several steps backwards,” he wrote. “You’ve not made your last payment, and you’ve not demonstrated that you understand or prioritize the severity of your situation.”

The next month, Fortress sued Cohen and demanded full repayment of the more than half billion loan, as well as a personal guaranty of up to $187 million—plus interest—from Cohen. Cohen counter-sued a month later, seeking to have the lawsuit dismissed and alleging that Fortress had reneged on an agreement to extend the loan.

Fortress had demanded a foreclosure auction on Cohen’s properties in May, but a judge ruled in Cohen’s favor in June and agreed to postpone it. In August, it was put on the schedule for November. In October, Cohen suffered another blow when the judge in the case ruled that Cohen had to pay the personal guaranty on the properties. (Cohen filed an appeal 11 days later, which is still pending.) Still, Cohen appeared to have more than enough resources to foot the bill: he had nearly $300 million in cash and investments as of June last year.

According to Fortress, Cohen then attempted to shield his personal assets so they couldn’t be taken from him to cover the guaranty. The firm’s lawyers alleged that Cohen had transferred ownership of his 219-foot, $50 million yacht Seasense and three smaller vessels to offshore entities in the Cayman Islands, while shifting ownership of his $20 million home in Greenwich, Connecticut to his wife Clo, a former Jimmy Choo executive. Cohen hit back, stating that it was just routine estate planning, but Fortress won a court judgment in the Cayman Islands delaying the transfer.

Cohen is also fighting the $187 million personal guaranty demanded by Fortress. In a filing ten days after the auction, Cohen’s lawyers argued that the auction sales mean that the guaranty amount should be reduced by $75 million to account for the sale of the assets and the release of a lien on another Cohen property. In December, his lawyers also argued that Cohen had nearly $350 million in equity in four buildings—3 Park Avenue, 979 Third Avenue, 805 Third Avenue and 622 Third Avenue— sufficient to cover the remainder of what he owes to Fortress. Once again, Fortress disputed his claim, pointing to the fact that those values were based “on stale, year-old valuations” that have declined since then, and that all four properties are burdened with outstanding mortgages. The proceedings are still ongoing.

Outside of the Fortress dispute, Cohen is still saddled with several debt-laden buildings that are showing their age. And while he had less leverage on his buildings than other Manhattan real estate tycoons, he was particularly vulnerable to the effects of the pandemic due to his concentration in older office towers.

“It’s difficult for the owner of a Class B office building to make their buildings competitive with Class A product,” says Knakal, referring to older properties compared to newer construction like Hudson Yards or One Vanderbilt, which is fully occupied.

“We’re talking about declines in the order of 30% to 50% in value on average,” adds Tomasz Piskorski, a professor of real estate at Columbia Business School. For real estate moguls with their wealth tied up in office towers, “it means they may no longer be billionaires.”

In a bid to entice tenants, many owners of older properties are now offering as much as a year of free rent as well as pricey allowances for improvements. But Cohen sees that as a losing proposition.

“We’re only doing deals that make sense. A lot of our competition is just throwing money at deals,” he said in November. Cohen insists he’s working on improving his buildings to make them more competitive, arguing that they should be valued higher now due to recent transactions such as a November deal that valued S.L. Green’s One Vanderbilt at $4.7 billion and the December sales of two office towers on Park Avenue. “We’re finishing up a major lobby renovation at 622 Third,” he said. “We’re reinvesting in our buildings.”

Those renovations are now complete, according to chief operating officer Cherniak, including a $13 million new lobby and exterior facade at 3 Park Avenue. Cohen’s also bullish on new lease activity to replace his vacancies. In Los Angeles, the space left by WeWork has been filled by the hospital and health science center Cedars-Sinai, an existing tenant. In New York, the firm expects to sign new leases at five of its least occupied towers in the coming months.

Cohen may have a point: Office leasing activity in Manhattan increased 17% year-over-year in 2024, the highest since 2019, according to real estate brokerage Avison Young. Still, older or lower-quality properties made up just 23% of new leasing last year, and rents at those buildings are only about half what’s charged by trophy buildings—a sign that the resurgence in leasing is leaving many of these aging towers behind as tenants continue to opt for newer ones.

Another strategy he has: converting office space to residential apartments and condos. In May, his firm filed for a special permit to convert 19 floors of its 38-story tower at 623 Fifth Avenue—across from the Rockefeller Center and atop Saks’ Fifth Avenue’s flagship store—to 172 condos. The project has since been scaled down to 60 to 70 condos, per Cherniak, but the firm is working on design plans. Another condo conversion project at 3 East 54th Street, which has views of Central Park, is further along, with the firm finishing the interior demolition last summer. “They’re all moving forward,” said Cohen.

Yet the lender on the 54th Street property filed for foreclosure in December, putting that project in doubt. (Cohen says he is in the process of refinancing the loan.) Another proposed conversion at 135 East 57th Street is now dead in the water. The Wallace family, which owns the ground underneath that building, opposed the conversion project and sued Cohen over unpaid rent in December 2023. In October, a judge ruled in the family’s favor, handing the building over to them.

According to New York office brokers who spoke with Forbes, if Cohen is able to follow through on the conversions, work with his lenders on the troubled properties and hold onto the buildings he wants while sacrificing others, he could survive the threats to his empire.

As his appeal on the Fortress case works its way through the courts, Cohen is looking south toward his planned 23-story, 400,000-square-foot tower in West Palm Beach, named West Palm Point. Located close by two other office projects being developed by billionaires—Stephen Ross’ One Flagler and Jeff Greene’s One West Palm—the three edifices-in-progess form part of what has been called “Wall Street South,” as financial firms from BlackRock to Citadel open offices in the fast-growing city. Together they will add nearly 900,000 square feet of office space. Cohen’s building there, which is set to break ground in March, is expected to be finished in 2028. He plans to finance the construction with a mix of equity and loans.

That could be a smart bet for Cohen, with Donald Trump’s election spurring business magnates and world leaders to flock to Palm Beach for its proximity to the new president’s Winter White House at Mar-a-Lago. According to Cherniak, the firm has already negotiated leases for six floors.

“We have all our approvals. The contracting is just about complete and we’re getting ready to close our loans and break ground,” Cohen said in November. “We’ve got leasing activity underway already.”

As for the legal battles, Cohen is going to keep fighting. “I’m not paying that personal guaranty. I’ve got defenses, I’ve got an appeal pending in the appellate division,” he said. “It’s not over by a long shot.”

Read the full article here