As American consumers continue to grapple with inflation and high interest rates, a new financial report reveals stark contrasts in credit card debt across the United States.

WalletHub used credit data from the U.S. Census Bureau, Federal Reserve, and TransUnion to rank the highest and lowest states for credit card debt and to estimate how long it would take—and how much it would cost—for residents in each of the 50 states and the District of Columbia to pay off their median credit card balances. The analysis includes credit cards that carried a balance and excludes store cards.

Newsweek contacted WalletHub for comment on Friday via email outside of usual working hours.

Why It Matters

According to the report, in 2024, Americans added $52 billion to their credit card debt, bringing the total amount owed by cardholders to approximately $1.3 trillion.

Americans aren’t equally affected by credit card debt. In some states, people carry lower balances. Experts attribute the regional differences to several factors, including cost of living, median income, access to financial education, and consumer spending habits.

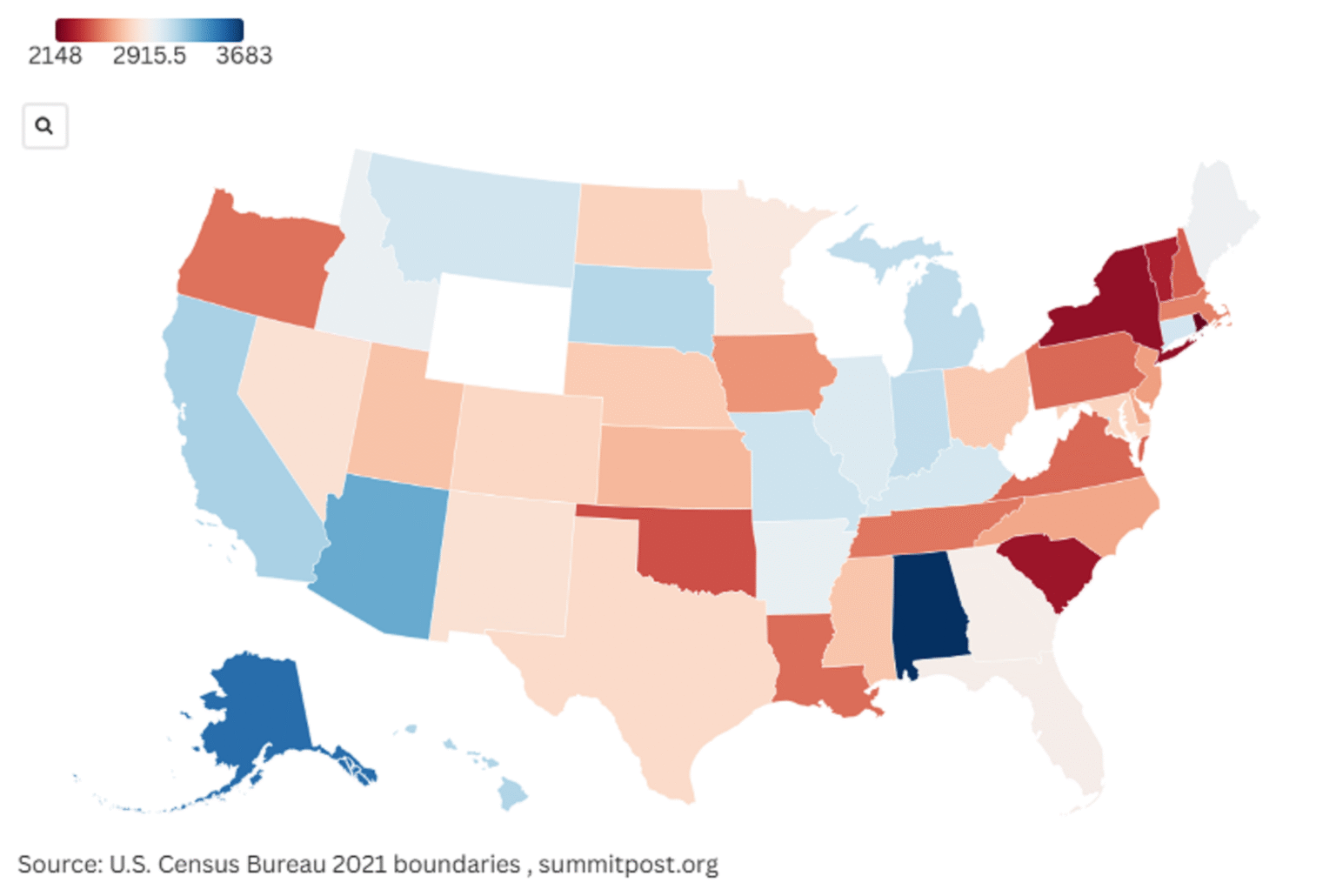

A map shows states with the highest and lowest credit card debt.

What To Know

The data reveals that residents of Alaska, the District of Columbia, and Colorado hold the highest average credit card debt per person in the country, while Iowa, Wisconsin, and West Virginia report the lowest levels.

Top 5 States with the Highest Average Credit Card Debt (2025):

- 1. Alaska $3,683

- 2. District of Columbia $3,502

- 3. Colorado $3,305

- 4. Georgia $3,186

- 5. Connecticut $3,162

Top 5 States with the Lowest Average Credit Card Debt (2025):

- 47. Indiana $2,420

- 48. Kentucky $2,296

- 49. West Virginia $2,261

- 50. Wisconsin $2,239

- 51. Iowa $2,148

Alaska ranks as the state with the highest credit card debt, with a median balance of $3,683 per person, spread across an average of 2.84 credit cards.

With the typical Alaskan paying $259 per month toward their credit card bills, it would take over 16 months to pay off the full balance, accumulating around $553 in interest along the way.

The District of Columbia has the second-worst credit card debt problem in the nation, with the median debt reaching $3,502 across an average of three credit cards per person.

Vermont ranks third in the nation for credit card debt burden, with a median balance of $2,627 spread across an average of 2.8 cards per person.

What makes this ranking notable, as reported by WalletHub, is that Vermont has just the 34th-highest median credit card debt nationwide. However, the low average monthly payment of $209 means residents take longer to pay off their balances, about 14.2 months on average, resulting in the third-longest payoff period and $344 in interest, the 16th-highest in the country.

Financial advocates are calling for stronger consumer protection laws and wider access to financial literacy programmes to help curb excessive borrowing. Some states, such as Oregon and Illinois, have already introduced legislation aimed at regulating predatory lending practices and enhancing credit education in schools.

“Talk to your credit card companies about lowering the interest rates,” says author and business strategist Sharon Lechter, per WalletHub. “If you have a history of paying on time, they may work with you.

“Make sure you pay all your balances down to below 30% of available credit as soon as possible,” she added. “Your credit score will improve when you do. For example, if you have a credit card with allowable credit of $10,000 and you owe $5,000 on it, paying it down to below $3,000 will improve your credit score.”

What People Are Saying

Chip Lupo, Financial Analyst, as reported by WalletHub: “Looking at the median credit card debt in a state can give you a good idea of whether people are struggling or doing well compared to people in other states, but it’s also important to look at how much residents put toward paying their debts off each month.

“Low average payments lead to long payoff timelines, which in turn lead to high amounts of interest accrued. For example, Vermont’s median credit card debt is relatively low, but it ranks as the state with the third-biggest debt problem due to low average monthly payments.”

What Happens Next

As Americans head into the latter half of 2025, economists warn that high credit card debt, if left unchecked, could contribute to a more widespread slowdown in consumer spending, which remains a key driver of the U.S. economy.

For individuals struggling with credit card debt, experts recommend speaking with a certified financial adviser and exploring options like balance transfers, debt consolidation, or enrolling in a debt management plan.

Read the full article here