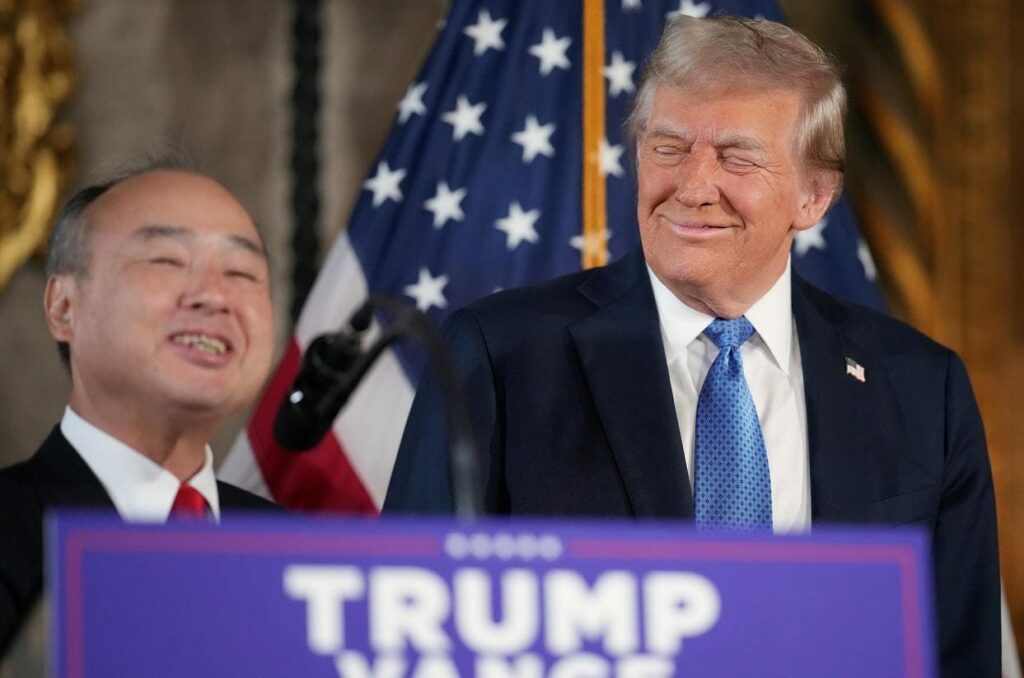

On Monday, SoftBank Group CEO Masayoshi Son and President-elect Donald Trump jointly announced a bold commitment: The Japanese tech conglomerate aims to invest $100 billion in U.S. projects over the next four years. It was a glitzy pledge from a global tech leader, teaming up with the incoming president with a promise to create at least 100,000 new American jobs in artificial intelligence and other emerging technologies.

The announcement eclipses a similar one Son made in 2016 as Trump first took office — a $50 billion pledge and 50,000 jobs. “President Trump is a double down president,” Son said during a press conference at Mar-a-Lago, Trump’s private residence in Palm Beach, Florida. “I’m going to have to double down.”

There’s just one hitch: SoftBank doesn’t actually have $100 billion at the moment. As of market close on Monday, its entire market cap was $97 billion, and it has $29 billion in cash on hand. It’s unclear how the company would finance its pledge and Son didn’t bother to detail how during its announcement.

The commitment is over the span of Trump’s presidency, so SoftBank will have years to make good on its promise. The company did fulfill its 2016 vow of $50 billion, with investments in dozens of companies including Slack and DoorDash. It’s more difficult to determine if it created that number of jobs, and the company did not provide an estimate at the end of Trump’s last term.

SoftBank didn’t respond to a request for comment.

The company’s most valuable asset is a majority stake in Arm Holdings, the British semiconductor company that went public last year. Arm’s market cap is currently $152.6 billion, with SoftBank’s roughly 90% stake valued at $137.3 billion. If liquidated, it would easily cover the company’s commitment. It’s unlikely, of course, that SoftBank would sell off its entire stake. Offloading large amounts of stock would probably cause the share price to crater. It could use its Arm stock as leverage to take out debt that would finance this commitment; but SoftBank has already taken out $8 billion in margin loans against its Arm stock.

In reaching into the Arm piggy bank, SoftBank doesn’t want to repeat missteps it took with Alibaba. In 2000, SoftBank invested $20 million in the Chinese ecommerce company, which went public in 2014 in the largest tech IPO ever, raising $25 billion. SoftBank reportedly owned 24% of the company at the time — a stake that dwindled to 7% in 2022, and down to half a percent by last May.

SoftBank’s announcement comes as several tech executives have tried to curry favor with Trump as he returns to power. In the last few days, Facebook parent Meta, Amazon and OpenAI have reportedly promised to donate $1 million each to Trump’s inauguration fund. With key supporters like Tesla CEO Elon Musk and venture capitalist Marc Andreessen, Silicon Valley has struck a different tone from when Trump first took office four years ago. Meta’s Mark Zuckerberg recently made a visit to Mar-a-Lago, and Google CEO Sundar Pichai reportedly has a visit in the works.

SoftBank is best known for its Vision Fund, a $100 billion venture fund it announced in 2017 for investing in tech companies worldwide, with half the funds raised from the sovereign wealth funds of Middle East countries like Saudi Arabia and the United Arab Emirates. But the Vision Fund came to be known for misplaced bets, including the ill-fated coworking real estate company WeWork, and Softbank posted an $18 billion loss. In 2020, the activist investor Elliott Management bought a $2.5 billion stake in the Vision Fund and pushed for restructuring and more transparency. By the time Softbank set out to raise more money for a Vision Fund 2, the company had trouble courting investors because of the first fund’s issues.

In trying to hit the $100 billion mark, the company could potentially count already-announced commitments to its tally. For example, Softbank reportedly invested another $1.5 billion in OpenAI last month through an employee tender offer. In May, the Japanese company said it would commit $9 billion a year to AI investments, though it didn’t specify where it would make its bets.

Trump, who described Son as “one of the most accomplished business leaders of our time,” didn’t seem worried about where the money would come from, and even pushed for more. “I’ve looked at their books and they do have the possibility of doing more,” Trump said Monday. “I’m going to ask them to do a little bit more.”

He then challenged Son to double his promise again to $200 billion. While remaining noncommittal, Son laughed and said he would “try to make it happen.” “He’s a great negotiator,” he said.

Additional reporting by Iain Martin.

Read the full article here