In July, the Defense Department made an unusual move for a federal U.S. agency when it purchased $400 million of newly created shares, plus warrants to buy additional stock, in the rare earths miner MP Materials. As part of the deal, the DoD also signed a 10-year agreement to buy rare earth magnets from MP Materials to power its future instruments of warfare.

The federal government came calling because MP Materials owns the only rare earth mine in the U.S. at its Mountain Pass site in California’s Mojave Desert, where it extracts, refines, and separates rare earth materials like neodymium and praseodymium. Those elements are essential ingredients in the magnets used by electric vehicles, drones, defense systems, robotics, wind turbines and other advanced technologies.

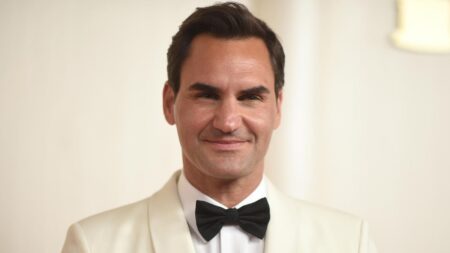

Shares in MP Materials have risen 150% since the DoD announcement, pushing James Litinsky, founder and CEO, into the three-comma-club. The 47-year-old Las Vegas resident is worth an estimated $1.2 billion, between his 8% stake in MP Materials (worth about $1 billion as of Friday’s market close) and over $200 million in cash and outside investments, per Forbes’ estimates.

Litinsky, who did not respond to Forbes’ request for comment on his wealth, is not your typical mining magnate. He studied economics at Yale and received his J.D. and M.B.A. from Northwestern University before working at investment giant Fortress Group and then founding his own hedge fund JHL Capital in 2006. His firm acquired $20.5 million worth of distressed bonds issued by Molycorp Minerals, the previous owner of the Mountain Pass site, in 2014. Three years later, during Molycorp’s bankruptcy proceedings, he turned those bonds into full ownership of the mine (which had flooded and was inactive). After getting $50 million in financing from a Chinese backer and orchestrating an 18-month cleanup effort, the newly named MP Materials began mining operations in 2018. Litinsky took the company public in 2020 through a SPAC, and its output has more than tripled since it began operations.

While Trump’s tariffs and trade war wreak havoc on global supply chains and raise consumer prices in the United States, MP Materials is uniquely positioned to benefit from the chaos, especially from the escalating standoff between the U.S. and China. That’s because China dominates the global rare earths trade, processing 90% of the metals and producing 95% of high-strength magnets; the U.S. imports nearly all of its 7,000 tons annually from China.

China has used U.S. reliance on its rare earth magnets as a key bargaining chip in its negotiations with Trump. Following Trump’s Liberation Day tariffs announcement in April, China began requiring foreign companies to obtain export licenses for rare earth magnets, which caused a crisis for U.S. firms: exports of the magnets to the U.S. declined 59% year-over-year in April and a whopping 93% in May, the Wall Street Journal reported. For MP Materials, the chokehold spurred a surge in domestic demand. “The sense of urgency, I’ve never seen anything like it,” Litinsky told Forbes in April.

Ironically, Litinksy has relied on the Chinese to get MP Materials off the ground and sustain its business prior to Trump’s trade war. Shenghe Resources, a Chengdu-based rare earths giant that is partially owned by the Chinese government, helped finance JHL’s 2017 bid by purchasing $50 million of future rare earth concentrate produced by MP Materials. Those funds helped pay for the mine’s cleanup effort and new capital costs, in return for an 8.4% stake in the company, which Shenghe still holds. (It has no operational involvement at MP Materials and does not have a board seat). Shenghe is also its largest customer, accounting for 80% of its $204 million in revenue last year. That is changing fast: after Liberation Day and China’s retaliatory tariffs, MP Materials announced it would stop shipping its products to China and focus on other buyers.

To wean off its reliance on China, MP Materials needs to continue vertically integrating. Its Mountain Pass refinery now processes around half of all ores excavated from the nearby mine, but it is still working to build out refinery capacities for the all-important neodymium-praseodymium metals that go into magnets. (The government’s $400 million investment should help on that front). Further downstream, MP Materials has built a magnet manufacturing facility in Fort Worth, Texas, which is already churning out magnets and is on track to begin full commercial production later this year. And in conjunction with the DoD deal, the company announced it will build a second U.S. magnet manufacturing facility at a yet-to-be-announced location with the help of a $1 billion bank loan.

All of this costly, but even more costly for MP Materials has been the precipitous decline in rare earth prices over the past couple of years, which has hit the bottom line hard. After netting a record $290 million in 2022, MP Materials made $24 million in 2023 and lost $65 million last year. Still the company remains well positioned with $750 million of cash and cash equivalents on its balance sheet, a growing roster of U.S. customers like General Motors, and now the government’s backing amid the ever-escalating trade war. Even with its stock trading at an all time high of over $73 per share, seven out of 11 analysts have a Buy rating on the stock, while the other four have a Hold.

Though Litinsky has no formal training in mining or geology, he clearly knows a good investment when he sees one. He’s turned a $20.5 million bet on distressed bonds into a $13 billion (market cap) company with strategic importance to his home country. “If you can buy a world-class asset at a discount to replacement cost at the bottom of a cycle,” he told Forbes last year, “luck finds you.”

Read the full article here