Bedrock Robotics, led by a veteran of Alphabet Inc.’s autonomous tech unit, is emerging from stealth with $80 million and plans to make heavy construction equipment work around-the-clock without human operators.

A team of engineers from self-driving robotaxi leader Waymo is eyeing another huge market to automate: construction equipment.

Last year, Boris Sofman, previously a star engineer at robotaxi leader Waymo where he worked to automate trucks, teamed up with former Waymo colleagues Ajay Gummalla and Kevin Peterson, along with engineer Tom Eliaz, to start Bedrock Robotics. They’re starting with excavators, the ubiquitous machines that do the heavy digging. The San Francisco-based startup isn’t designing its own line of construction machinery, but instead plans to modify existing equipment with cameras, lidar, computers and AI software that enables them to work around the clock–including in blistering heat when human workers would need regular breaks.

Bedrock, which has also brought on former Uber Freight EVP Laurent Hautefeuille as COO, is emerging from stealth with $80 million in new funding and plans to begin commercial operations in 2026.

Waymo’s success with robotaxis shows “the state of technology just being right, where we’re seeing it work on one of the hardest applications in the world,” Sofman told Forbes. “That’s exactly the type of building block that catalyzes change. When you tally up all the ways we use these specialized heavy machines, it’s another one of those transportation-style spaces that is due for a wave of what’s happening in transportation.”

It’s a tricky time for the massive U.S. construction industry. There’s huge demand for new housing, data centers and factories, but the Trump Administration’s tariffs and its aggressive immigration crackdown are boosting materials costs and exacerbating an already tight supply of skilled workers.

“It’s this fascinating situation where you have an astronomical macroeconomic tail and a need to re-industrialize the U.S.,” Sofman said. “At the same time, the labor pool, even more aggressively than what we saw in trucking, is going the opposite direction.”

He isn’t yet providing revenue targets, but the market is a big one. Infrastructure upgrades aided by the passage of Biden’s Bipartisan Infrastructure law, combined with higher demand for new warehouses, data centers and factories, will likely boost U.S. excavator contract revenue to $145 billion this year, up 2.5%, according to an IBISWorld report. Bedrock isn’t sharing a valuation yet but will likely raise additional funding within a year.

Autonomous excavator testing is underway at Bedrock’s sites in Arizona, Texas and Arkansas, and the company plans to expand testing to a customer’s work site next month. If all goes well, “we expect to get the first operator-out form in 2026,” said CEO Sofman, who has a PhD in robotics from Carnegie Mellon University.

“Boris has assembled an extraordinary founding team, many of whom I had the privilege of working with,” said former Waymo CEO John Krafcik, who’s invested an undisclosed amount in the startup. “It’s an exceptional group with the technical depth, grit and vision to make autonomous construction machines real.”

Unlike Waymo or autonomous trucking developer Aurora, the startup’s capital needs are much lower as it’s not building or buying fleets of vehicles or a large factory. And working on private commercial construction sites means Bedrock doesn’t have to contend with the regulatory challenges of operating robotaxis and robotic semis on public roadways. Speed isn’t a factor either, because work sites operate at a human pace. Sofman estimates projects could see at least a 20% reduction in overall costs, but more importantly, could be completed faster than those using only human workers.

Labor Shortage

There’s already a shortfall of laborers to replace the approximately 500,000 people a year who are aging out or retiring, according to the Associated Builders and Contractors trade association. At the same time, Trump’s 25% tariff on imported steel and aluminum and his threat to boost the tariff on Canadian lumber to 35% are raising costs across the board.

The full impact of the current immigration crackdown isn’t yet clear, though 34% of construction trades workers in 2023 were foreign-born, nearly double the 18% rate among all workers, said Ken Simonson, chief economist for the Associated General Contractors of America trade group, citing U.S. census data. Still, the portion of immigrant workers is lower for skilled trades that require certification, like excavator operation, he said.

Given the shortage, the technology isn’t likely to kill jobs but instead allow human crews to do everything more efficiently, said Eric Cylwik, director of innovation for Sundt Construction, an Arizona-based firm that’s helping Bedrock develop and test its tech, along with Texas-based Zachry Construction and Champion Site Prep.

“We’re not instantly going from people to no people. I don’t think anybody thinks that’s a reality of what could happen,” he said. Instead, Bedrock’s tech will enable Sundt and its competitors to do things like more overnight work, where robotic excavators could complete boring, repetitive site preparation tasks like loading dump trucks with dirt and allow human workers to focus on things like pipe installation. It could also help aid crews at remote work sites, “where we can’t get enough operators for the equipment we want to deploy,” Cylwik said.

Bedrock isn’t saying how much it will charge to upfit complex digging machines like excavators that cost $500,000 new, though its ability to modify existing equipment with autonomous capabilities is extremely appealing to companies like Sundt. “It’s nice because it works across our entire fleet, and it can be done for a fraction of the cost of buying a brand new excavator,” Cylwik said.

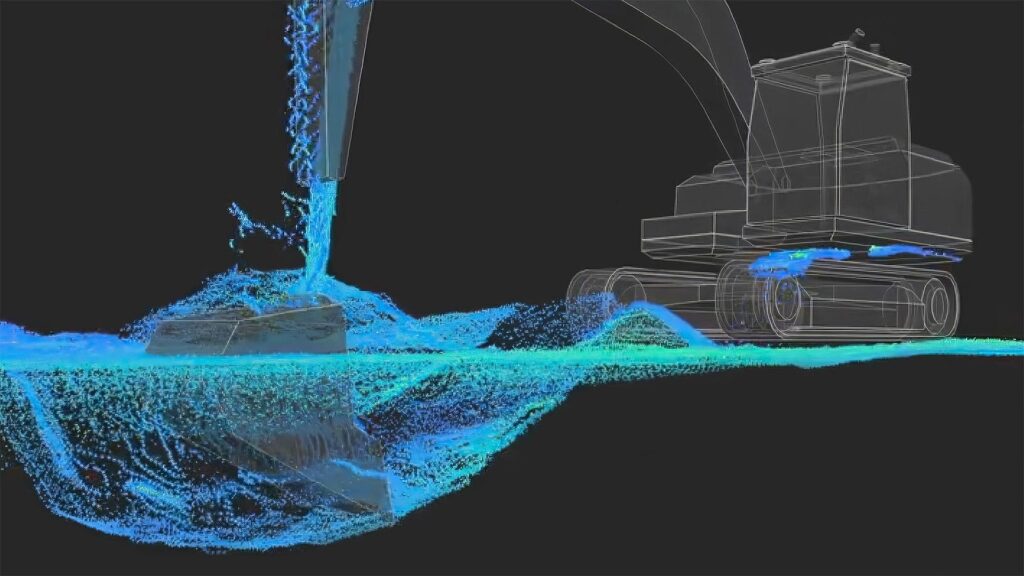

Laser lidar, which can instantly create 3D images of the world, even at high speeds, is critical for safe driving on the road. On a construction site, it’s able to map ground conditions in detail and precisely measure how many cubic yards of dirt are removed with each scoop of the excavator, essential information for contractors.

For some projects, “we have to have a registered land surveyor come out and quantify how much earth we move every time we go for a payout,” Cylwik said. “With a system like this, we can say every single day exactly how much earth every piece of equipment moved,” which affects how quickly Sundt gets paid. “There are some deep-seated impacts on the business of construction by being able to analyze that much data that quickly.”

The speed with which Bedrock has gone from concept to testing to planned commercialization is what appealed to venture firm Eclipse, which led its May 2024 seed round. The current Series A was led by 8VC. Additional backers are Two Sigma Ventures, Valor Equity Partners, Nvidia’s NVentures, Crossbeam Venture Partners, Raine Group, Tishman Speyer, Atreides Management, Al Rajhi Partners and Samsara Ventures.

“It’s an absolute whirlwind,” said Eclipse partner Aidan Madigan-Curtis. “The company started in May [2024] and they already had something working autonomously at their test site by early November. It’s kind of bananas. They’re now doing [human] operator-out, full autonomous excavation at their test site, and they’re going to be doing that at a customer site next month.”

They’ve also targeted an industry with little to no initial competition. Leading equipment manufacturers such as Caterpillar and John Deere are moving into automation with robotic mining trucks and tractors, but they haven’t focused on things like excavators, wheel-loaders and dumptrucks that are vital to commercial construction. Before Bedrock, “there have been zero opportunities to test out [automated] construction equipment,” Cylwik said.

Asking why Caterpillar and Deere haven’t created competing robotic solutions for construction is like asking why BMW didn’t create Waymo, Sofman said. “The mechanics of what they’ve designed is magical. These are such incredible machines, and the fact that they operate so reliably and so thoughtfully in such difficult environments is a marvel, but it’s a different DNA than the sort that you need to build out a machine learning team.”

Instead, he’s hopeful Bedrock will partner with those companies.

“We’re not competing with Caterpillar and trying to make machines. We’re trying to make machines more intelligent,” he said. “It becomes a very complementary element to the whole ecosystem where Caterpillar and Deere machines become more intelligent, the general contractors and subcontractors can do much more work, more productively with a higher margin–and the whole society benefits because more work gets done and prices become a lot more attainable.”

Read the full article here