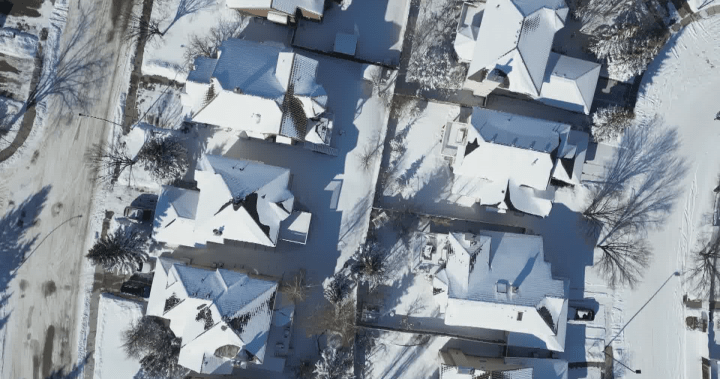

The City of Calgary has mailed out more than 600,000 property assessment notices and many homeowners will find their homes are worth about the same as last year, after years of double-digit increases.

According to the city, the typical single-family home is worth just one per cent more this year at $706,000, compared to $697,000 in 2025.

Meanwhile, city assessments show the typical Calgary condo is worth three per cent less at $347,000 compared to $359,000 last year.

Multi-residential apartments, which the city said only make up a “small fraction” of the residential property class, are valued eight per cent higher this year after showing the “strongest demand.”

It’s a stark contrast compared to last year’s assessments, met with sticker shock by homeowners, that showed the value of single family home climbed 14 per cent, and a condo’s value soaring 22 per cent.

For Calgary’s city assessor, Eddie Lee, he hasn’t seen a year-over-year change like this one since the 2008 financial crisis.

“There was the dot com bust and the sub-prime mortgage scenario. We saw residential and non-residential values climb at really high rates. Then that happened, and we saw declines in assessment values and market values as a whole,” he told reporters at a city press conference Thursday.

Lee said Calgary has returned to a more balanced market over the last year, largely driven by “stabilizing net migration,” and an increase in the city’s housing supply.

“The market is relatively flat compared to last year’s growth, signalling reduced market pressure and greater stability,” he said.

Get daily National news

Get the day’s top news, political, economic, and current affairs headlines, delivered to your inbox once a day.

This year’s assessment is based on an estimate of a property’s market value on July 1, 2025, as well as the condition and characteristics of a property as of Dec. 31, 2025.

According to the city, the communities with the biggest increases in assessed value include Cedarbrae, Woodbine, Diamond Cove, Deer Ridge, Red Carpet and Bowness.

Joel Semmens, a realtor with RE/MAX House of Real Estate said the city’s housing market has been exciting for the last two years, with 2025 serving as his best year in terms of sales volume.

“This year has been an interesting start,” Semmens told Global News. “I feel the market is pulling back a little bit, the condo market for sure, there’s a lot of inventory in the condo market, sales are getting a little stickier.”

With assessments in the mail, the city has opened its customer review period until March 23, in which homeowners that wish to dispute their assessment can call 311 or visit the city’s website.

How assessments impact property taxes

A property assessment is used to determine a homeowners’ share of property tax, which depends on how much a property’s value increased in comparison to to all residential properties, which is one per cent this year.

Calgary city council approved a 1.6 per cent property tax increase for 2026.

According to the city, the typical single-family home valued at $706,000 is expected to pay $2,741 in property taxes in 2026, an increase of $3.57 monthly.

Property taxes are expected to be $1,347 in 2026 for the typical condo assessed at $347,000, a reduction of 3.1 per cent, which is $3.54 lower each month.

If your property’s value increased by more than one per cent, you’ll pay more in property taxes, while if your property’s value increased by or less than one per cent, you’ll pay the 1.6 per cent tax increase or less.

Homeowners can calculate their property tax bills based on their assessments by visiting the city’s online tax calculator.

However, the estimates will be finalized in the spring after the province tables its budget, and sets out its share of property taxes.

According to Lee, the provincial share of property taxes is set to increase by 11.9 per cent for the typical single-family home in 2026, estimated at around $16 monthly for the typical homeowner.

Forty per cent of the property taxes collected by the city are expected to go to the province this year, compared to 37 per cent last year.

“Those numbers are not finalized,” Lee said. “They are taken from Alberta’s 2025 budget document, where they have indicated their intent to continually increase the amount of property taxes the province collects to fund education.”

Non-residential property values

On the commercial side, the city said the value of non-residential properties also increased by one per cent.

The value of industrial properties increased by three per cent, the city said, making it the “strongest performing” non-residential property type, while retail properties saw values assessed two per cent higher than last year.

Offices saw a four per cent decline in assessed value, according to the city, due to ongoing uncertainty and mergers and acquisitions in the energy sector.

Calgary’s top five most valuable non-residential properties are:

- Chinook Mall – $1,039,363,000

- Calgary Airport – $1,013,320,000

- Eighth Avenue Place – $779,600,000

- Bow Tower – $771,000,000

- Brookfield Place – $567,500,000

Read the full article here